Is there a direct impact when implementing divorce mortgage planning into the divorce settlement process? Yes. Let me explain.

Many professionals use the term “equity buy-out” incorrectly. Instead, they associate the term directly with a type of mortgage loan. An equity buy-out is not a mortgage loan but a process of acquiring another party’s interest in a jointly owned home. You may facilitate an equity buy-out by equalizing other marital assets or obtain new mortgage financing to access the equity needed to satisfy the buy-out.

The problem? A divorce settlement agreement may detail the terms of the equity agreement; however, it cannot dictate what type of mortgage financing may be available. As a result, the options available may have more to do with details of the actual property rather than the borrowing spouse’s credit and income. Additionally, the settlement agreement itself may directly impact the ability to access the equity in the real property.

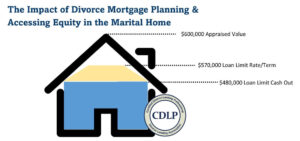

To briefly summarize, there are two types of mortgage refinance: Rate and Term and Cash-Out. The primary difference between the two is access to equity. A Rate and Term can allow access up to 95% of the home’s value, whereas a Cash-Out refinance limits access to 80%.

If you have an appraised value on the marital home of $600,000 and are limited to a cash-out refinance, you can only borrow up to $480,000. However, with a rate and term refinance, you could borrow up to $570,000. That’s a significant difference of $90,000 in equity.

Jane is retaining the marital home valued at $600,000 with an existing mortgage of $400,000. The equity in the property of $200,000 is to be divided equally between Jane and John. Depending on the circumstances, if the refinance is categorized as a cash-out refinance, Jane could only borrow up to $480,000 and, after paying off the existing mortgage, would be short $20,000 to complete the equity buy-out.

What triggers a refinance to be categorized as a cash-out? The two most common triggers are:

Implementing divorce mortgage planning into the divorce settlement process can profoundly impact the outcome. Certified Divorce Lending Professionals (CDLP®) will work directly with you and the divorcing homeowners to identify any conflicts between the actual property, outstanding mortgages, and the marital settlement agreement to help position the borrowing spouse to obtain the best mortgage financing options available.

The role of a Certified Divorce Lending Professional is not to provide tax or legal advice. Instead, working directly with the divorce team, a CDLP® incorporates divorce mortgage planning into the overall process with a unique and solid understanding of the intersection of family law, financial and tax planning, real property, and mortgage planning.

How are you integrating divorce mortgage planning into your case management? Involving a Certified Divorce Lending Professional (CDLP®) early in the divorce settlement process can help the divorcing homeowners set the stage for successful mortgage financing.

It is always important to work with an experienced mortgage professional who specializes in working with divorcing clients. As a Certified Divorce Lending Professional (CDLP®), I can help answer questions and provide excellent insight. Please don’t hesitate to reach out to me directly if I can provide additional information.

If you’d like to discuss this content further, reply to this email or schedule a meeting with me here: https://meetings.hubspot.com/jennifer_brown54849

written by:

Jennifer f.brown

Copyright 2023 – All Rights Reserved. Divorce Lending Association, LLC